Your donation will support the student journalists of Fossil Ridge High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

What on earth does TABOR stand for?

A guide to understanding school funding legislation in Colorado

April 25, 2018

As of Wednesday, April 25, 23 Colorado school districts serving over 600,000 students have called off school on Friday, April 27. For many students and parents, this was a first wake-up call to the current relevance of debates over school funding. The question of how Colorado’s legislature will proceed with funding decisions will not be answered any time soon; however, teachers, students, and parents alike have a stake in upcoming decisions, because all will be affected one way or another by bills like Initiative 93. In addition, there are numerous pieces of past legislation that inform debates over school funding, and this guide provides a resource for understanding the key few. To skip to a certain piece of legislation or financial term, hover over the word “chapters” in the upper right section of the screen.

TABOR

For example, if the Consumer and Price Index calculates average annual inflation to be 3%, and Colorado’s population increases by 1% during the year, the state government can spend a maximum of 4% more than the previous year. — Isabella Mahal

TABOR stands for the Taxpayer Bill of Rights. It was adopted as a constitutional amendment in Colorado in 1992, and though several other states have proposed the bill, none of them have adopted it. At its core, the legislation limits annual state expenditures. Each year, the annual inflation rate is added to the annual percentage change in the state population and that sum represents the maximum percentage of additional spending that can be added to the previous year’s spending. If that amount is to be exceeded, the legislature must either reach a supermajority assenting vote, or voter approval must be given. Meanwhile, if the annual revenue collected by the state in taxes is higher than the calculated percentage, the extra revenue must be returned to taxpayers in the form of tax refunds. (Center on Budget and Policy Priorities)

The Gallagher Amendment

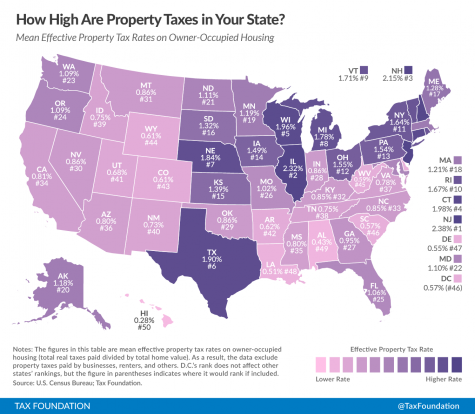

The Gallagher Amendment was passed in 1982, and its stated purpose was to “maintain a constant ratio between the property tax revenue that comes from residential property and from business property” (Great Education Colorado). Though the math behind it is complex, the amendment basically states that the assessment rate for residences, or the percent of property value that is taxed, cannot grow faster than the assessment rate for business property. Because population has grown dramatically in the past years in Colorado, residential real estate values have increased, and so the amount of taxes collected from property have decreased by nearly two-thirds since Gallagher’s adoption. Before 1982, a majority of school funding came from property taxes, but the reduction in tax collection means that school funding must now come out of the state’s annual budget.

Amendment 23

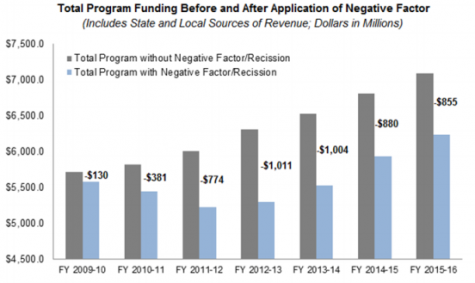

When passed in 2000, the Colorado Constitution’s Amendment 23 was attempting to reverse budget cuts that state school districts had been experiencing for a decade. The amendment required K-12 funding to increase by inflation each year plus 1% between 2001 and 2011, and also mandated that funding would increase by inflation for the indefinite future. However, because of the national recession in the late 2000s and Colorado’s resultant economic woes, Amendment 23 didn’t follow the pattern set in place originally. According to Great Education Colorado, “the funding level approved by the legislature for the 2015-16 school year is fully $855 million ($1000 per pupil) below what is required under… Amendment 23.)

Amendment 23 also serves to require that funding for programs like special education and transportation increase by the same percentages as general education funding each year. It theoretically allows K-12 spending to reach beyond the inflation plus 1% limit as well, if there is demonstrated need in a school district for priorities such as textbooks and early childhood education.

The Negative Factor

The amount of money that each Colorado student is alloted by the state each year is determined by the School Finance Act formula. Essentially, this formula takes a base amount of per-pupil funding, which is the amount that must increase each year per Amendment 23, and then takes into account additional variables to give schools more funding. For example, factors such as the size of a school district, the cost of living in the area, and the number of students in the district who qualify for free and reduced lunch could all represent ways for districts to increase their state funding (Great Education Colorado).

The negative factor is a coined term to represent a piece added to the School Finance Act formula in 2009. The negative factor allows the variables that would otherwise increase school funding to be manipulated so that the actual amount (base plus variables) spent on each district doesn’t change from year to year. The legislature calculates the required base for each school year based on Amendment 23, and then it decreases the amount that a district receives for its variables accordingly. According to the Colorado Legislative Council Staff’s Issue Brief on the negative factor, “the cost of the negative factor has grown from… $130 million, to its present value in [fiscal year] 2015-16 of about $855 million.”

PERA

PERA stands for the Colorado Public Employees’ Retirement Association, established by state law in 1931. Colorado PERA’s website explains that, “members of PERA include employees of the Colorado state government, public school teachers in the state, many university and college employees, judges… and the employees of many other public entities.” The association essentially stands in for Social Security for public employees, and they then receive retirement and other benefits from money they contribute while working. Under PERA, employees are required to contribute 8% of their salary and employers contribute additionally to the retirement trust funds. A Board of Trustees manages and invests the funds, which become available to public employees either when they turn 65 or when they meet other specific requirements.

Senate Bill 18-200

Senate Bill 18-200 is a proposed initiative that has been assigned to the Senate Finance Committee as of March 7, 2018. The bill currently has bipartisan sponsors from across the state, and if passed by the legislature and signed into law by the governor, it would introduce several reforms to PERA’s current operating guidelines. According to PERA on the Issues, “the bill upholds the PERA Board’s goal of bringing all five of PERA’s Trust Funds to 100 percent funding within 30 years.”

Major changes to PERA that would occur under SB 18-200 span several areas. The definition of salary would come to include amounts deducted from pay for a cafeteria plan and/or a qualified transportation plan. Unused sick leave that can legally be converted to cash payments is included in salary, which insurance premiums paid by employers are not. Member contributions to the retirement fund would increase to 11% over an incremental period of three years. Retirement benefits through PERA require different numbers of “service years”, and the way these are counted would shift under PERA. Current members of PERA who are receiving benefits also receive 2% cost of living adjustments (COLA), which would be reduced to 1.25% increases beginning in 2020. Further analysis of each aspect of SB 18-200 is explained on the Colorado General Assembly’s bill website.

Ballot Initiative 93

Ballot Initiative 93 is known as the “Great Schools, Thriving Communities” ballot measure, and the proposal hopes to expand “educational opportunities for our students to prepare them for success in college, career and life.” (Great Education Colorado Action). To be placed on the ballot, 98,492 signatures need to be collected on the official petition by July 11, 2018.

There are three essential points to the budget language. Initiative 93 would create a tax on federal, taxable income above $150,000 for individuals and one on corporations. The increased income from federal taxes would be legally required to be put into a “quality public education fund” (Initiative 93). The new brackets would appear as follows:

- No change for income between $0 and $150,000;

- 0.37 percent (an average of $81) for income between $150,000 and $200,000;

- 1.37 percent (an average of $729) for income between $200,000 and $300,000;

- 2.37 percent (an average of $3,456) for income between $300,000 and $500,000; and

- 3.62 percent (an average of $42,528) for income above $500,000.

- 1.37 percent for corporations

If your home is worth $100,000 (actual value), and you have an assessment rate of 7.96 percent, you are taxed on $7,960 (your assessed value), not the full $100,000.

— Tyler Silvy for the Greeley Tribune

Additionally, Initiative 93 would decrease assessment rates for both residential and non-residential property in Colorado. According to the Greeley Tribune, “the assessment rate is the percentage of your home’s value at which you’re taxed.” The new rates would shift from 7.2% to 7.0% for residences and 29% to 24% for nonresidences, essentially decreasing the amount of money one must spend on property taxes to account for the increase in income taxes. Finally, under the initiative, only public schools could utilize funding from the increased income taxes and that funding would be required to increase by inflation each year (up to a maximum of 5% per year).

The priorities of the initiative are to increase base funding for all students, provide funding for full-day kindergarten in Colorado, expand the definition of students “at-risk” to include all who qualify for free and reduced lunch, and increase the amount of state funding for English Language Learners, Special Education programs, and Gifted and Talented programs. (Great Education Colorado Action).