Fossil brings the heat to the Stock Market Challenge

November 13, 2017

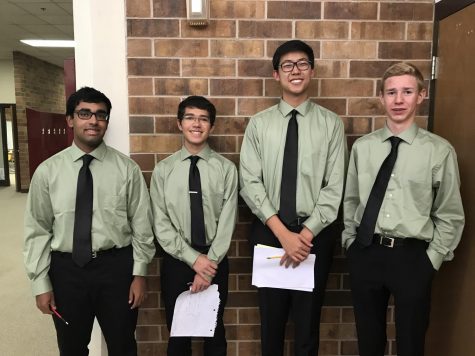

Photo Credit: Junior Achievement

On Friday, November 10, Junior Achievement (JA) hosted a stock market challenge at the Drake Center for students from over 40 high schools across Northern Colorado. Fossil Ridge High School sent eight competitors from the sophomore, junior, and senior classes, and they placed 16th after a fast-paced morning of trading, waiting, and working together to grow $500,000 as quickly possible on the stock exchange.

Prior to the competition, each team had to pick either a conservative, balanced, or aggressive stock package to start the day off. Fossil’s own team picked an aggressive one, and junior participant Caleb Knight explained that they had to “analyze the market to find opportunities that may not seem like opportunities to other people, and bet on them.” He participated in the stock market challenge last year as well, and he feels that, “you can make a lot of money, or you can lose a lot of money. It’s a great adrenaline thrill.”

When the students arrived at Drake Road and Shields Street at 8:30 am, they were provided with doughnuts for breakfast, courtesy of JA. According to Fossil Finance teacher Ms. Seeton, the competition is contracted through a Canadian company, who began the day by explaining some rules to the students. Then, an opening bell is rung to signal the start of trading, just like on a real stock exchange.

At that point, the challenge was on. Thirty minutes of trading commenced, and the Fossil team scattered across the stock floor to buy and sell aspects of their portfolio. Each minute represented one day of trading, and because Fossil had picked an aggressive one to begin, they already held more volatile stocks than some other teams. However, the bigger the risk, the bigger the potential return, and by the end of the first simulated month, Fossil was in tenth place ahead of more than twenty other teams.

Throughout the days of trading, “floor traders” circled the room, handing out news stories pertaining to the pretend stocks. Ms. Seeton explained that, “depending on the news, that’s going to make their stocks go up or down, and make them more or less attractive. If they don’t own the stock, and it’s good news, they might want to go all in and buy that stock. If it’s good news and they do own it, they’re going to want to keep it.” The whole simulation was intended to parallel the realities of stock ownership, though sophomore Ryan Suckow felt that, “the scenarios were planned, but it didn’t feel like the exact way that the stock market works.”

During the second thirty minute round, Fossil came in strong. They quickly climbed to third place using a strategy they had devised during the short break period they were given. The team then decided to try to push themselves higher in the rankings by consolidating all their money into a single stock, but they didn’t put the trade in quickly enough. Several other teams jumped ahead of them in the last few minutes, and they finished the morning in 16th place. However, Suckow still believed it was a great experience. The team “assigned specific duties to people to fulfill roles, and they had certain people watch certain stocks,” which made everyone feel included and maximized each individual’s contributions.

Though junior Aaron Swets thought that “it would be somewhat boring, it was really exciting.” He attended the competition to see how much he knew about stocks and trading, and he felt the team collaborated well, talking about what needed to be traded and when. However, if he could do the challenge again, he would go in with a smaller group to eliminate some of the confusion that came along with an eight person team.